Employers are significantly less open to hiring older workers than bringing in younger talent, according to research by the Chartered Management Institute, and perhaps the financial advice profession is the exception that proves the rule.

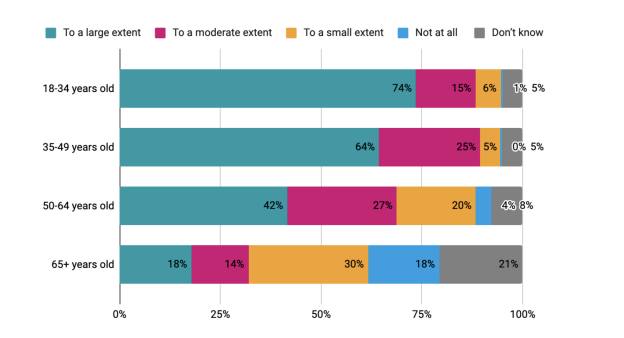

In the CMI’s survey, three-quarters of managers (74 per cent) said their organisation is, to a large extent, open to employing people between the ages of 18 and 34. This drops to two-thirds (64 per cent) for people between 34 and 49.

This willingness continues to drop further, with two in five (42 per cent) saying their organisation is, to a large extent, open to employing between the ages of 50 and 64. One in five (18 per cent) said so about employing people aged at least 65.

But when it comes to financial advice, Steve Williams, Wren Sterling’s director of HR, says the reverse is “absolutely true within an industry where experience, qualifications and people skills are much sought after to support clients through often complex financial matters.”

Openness to employing different age groups

To what extent, if at all, would you say that your organisation is open to employing the following age groups?

“The demographic of most clients is 60-plus, and they often look to someone of a similar age and demographic who ‘understands them’,” says Williams. “As an employer, age is not a consideration, and conversely older candidates are more likely to have the qualifications and experience required.”

Indeed, as far as retail investment advisers, the majority (33 per cent) are between the ages of 50 and 59, according to data published via a freedom of informtation request from the FCA in 2021. Meanwhile, one in 20 (6 per cent) were under the age of 30.

But the ageing demographic of financial advisers is one of the diversity challenges facing the financial services and planning industry, adds Williams. “We are paying the price for not actively encouraging newer entrants into a profession that provides great variety and significant rewards, both financially and intellectually.

“The biggest challenge facing younger people is gaining the relevant qualifications needed to provide regulated financial advice. Like many businesses, we are addressing this by creating career paths via apprenticeships and an academy.

“These programmes allow younger people to gain the skills and qualifications to develop a career in financial services, whether that is as an adviser, a paraplanner or moving into management and compliance roles.

“More importantly, who will they learn from? Often their older, more experienced colleagues who can support and mentor them.”

For those already in the industry, ValidPath chief executive Angus MacNee agrees there are less barriers than in other sectors, partly due to regulation and the qualifications required.

“I also think it is fair to say that the financial services sector, and in particular advice, welcomes people from all types of backgrounds and age ranges,” adds MacNee.

“As a network, we see people joining firms that are looking for a career change. These are often people coming from a successful career in business, accounting or finance.

“They can add a great deal to an advice business, as they bring a depth of understanding and empathy for many clients. This is particularly true with clients that are business owners or those that have complicated financial situations.