Finance professionals will regularly talk about the fact there simply are too many advice platforms in the market and that what we have now is an unsustainable situation.

In particular you will hear this refrain from those who remember working as an adviser 10 years ago when there was a mere handful of ‘wraps’ or ‘fund supermarkets’, as they were called then, to choose from.

Over the last decade the platform market has grown and evolved and there are now over 20 platforms UK intermediaries can use to manage their clients' assets.

A natural progression for an overcrowded market is for consolidation to take place, where good fits are found between once rival businesses and a takeover is achieved.

This is by no means unique to platforms, it is a cycle which can be seen all industries.

Market shift

For such a so-called crowded platform market however, the rate of consolidation to date has been slow.

That said, there have been some significant mergers over the years including:

- Skandia and Selestia

- Standard Life and AXA Elevate

- Aegon and Cofunds

Examples of consolidation between smaller platforms include:

- Embark and Avalon

- Interactive Investor and TD Direct

In its Investment Platforms Market Study interim report, the Financial Conduct Authority (FCA) highlights the make-up of the platform market has been shifting significantly despite the lack of headline grabbing deals going on.

In an annex to the report the FCA shows how the market share has become more diffused over the past few years.

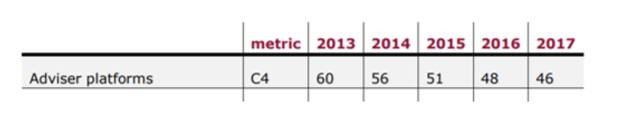

The four largest platforms held 60 per cent of the market share between them in 2013. In 2017 they held 46 per cent.

Figure 1: Percentage of the market share held by the four largest adviser platforms

Source: FCA Investment Platforms Market Study interim report. C4 is defined as the sum of the market shares of the four largest platforms.

Another important development is how the pool of technology providers behind platforms has been shrinking.

In the UK advised market there are only three main technology providers: FNZ, GBST and Bravura. There are still a few platforms which work on their own proprietary technology such as Transact, Parmenion and James Hay but generally the trend has been a move away from companies building their own software.

In 2017 consultancy Lang Cat predicted proprietary technology would decrease from being used by 41 per cent of the market to 15 per cent by 2020.

The technology behind platforms is worth noting when looking at the topic of platform consolidation because, in theory at least, it makes for an easier merger if two companies are already using systems from the same provider.

Slow and steady

Independent platform consultant, Stan Kirk, says from what he has seen among the consolidation deals, it has generally been opportunistic on the part of the buyers when they see an opportunity to increase their assets under administration.

He explains: "Most so called 'consolidations' in the platform world have consisted of opportunistic moves at a cheap price to hoover up some more funds under direction from platform owners who have become disenchanted with their platform business experiment (much money spent, little return).”