New data from HM Revenue & Customs, released on March 8, left little to celebrate on International Women’s Day, as it showed that women are still earning considerably less than men at every stage of life.

Across all ages groups, the median income was £28,700 for males and £23,600 for females – a huge gap of 20 per cent. This disparity widens further as workers approach middle age.

In terms of high earners, men earning in excess of £1mn outnumber women by almost 10 to one (17,000 men compared with 2,000 women). That ratio falls closer to five to one (18 per cent) for those earning more than £500,000.

More than 1mn men earn in excess of £50,000 more than women.

The data also showed that women are out of the workplace or earning considerably less during the years they are most likely to have young children. The only place women outnumber men is at the lowest levels of income.

“These latest figures reiterate the dire need for government action in boosting women’s finance,” said Quilter tax and financial planning expert Rachael Griffin.

“At present, there is a significant gender pay gap during working life, and women will only suffer further when it comes to retirement as they simply will not have had the opportunity to build a good enough pension pot.

“What’s more, they also risk missing out on state pension funds if they have not achieved the full 35 years’ of national insurance contributions following the introduction of the new child benefit rules in 2013.”

Limited prospects

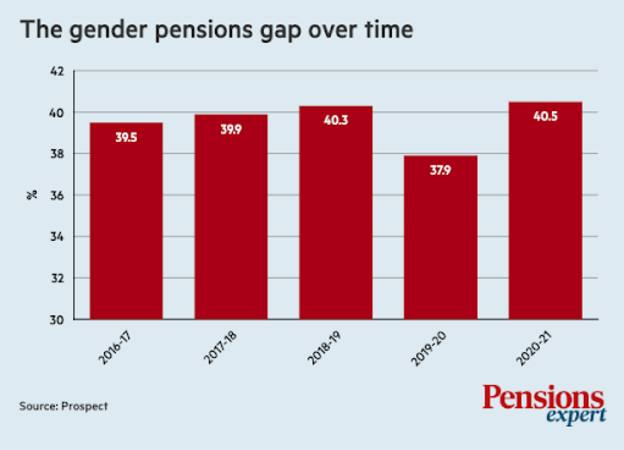

New research from trade union Prospect estimates the gender pensions gap at 40.5 per cent for 2020-21.

This represents an average shortfall of £7,100, significantly more than the gender pay gap, and remains essentially unchanged in the five years since Prospect first estimated the gap.

More worrying is that current government policies are failing to provide any improvement, despite a clear increased focus on the subject.

The data is published in its latest annual gender pension gap report, in which it warns of a “ticking gender pension time bomb” if radical action is not taken to address the gap.

“This report shows that the gender pensions gap remains extremely high,” said Prospect senior deputy general secretary Sue Ferns.

“Prospect’s number one ask of government has been for them to produce an official definition of the gender pensions gap and to report on it centrally. Progress has been made on that but we now need warm words to be matched by concrete action.

“Things are moving far too slowly. We are currently condemning generations of women to significant financial inequality in retirement. It is simply not good enough.”

Data released by Legal & General in 2022 highlights that the difference in pension pot sizes between men and women begins at the start of their careers as high as 16 per cent, and double by the time they are in their forties.