The tax shake up that abolished mortgage interest tax relief for landlords has been touted as a factor behind the rise in the number of buy-to-let properties being repossessed.

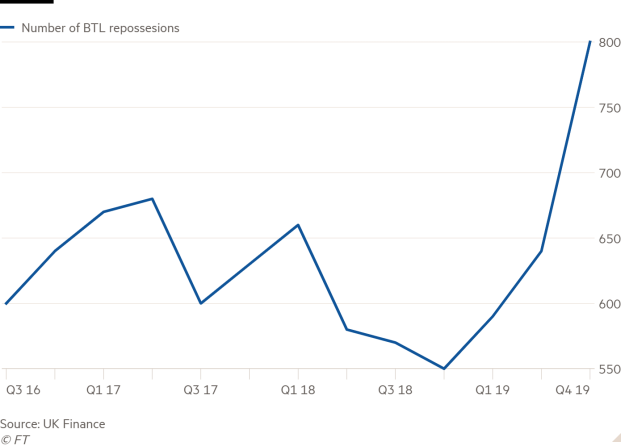

Latest figures from trade body UK Finance showed 800 buy-to-let mortgaged properties were taken into possession in the third quarter of 2019 — 40 per cent up year-on-year.

The total had risen gradually since the end of last year, from 550 in the last three months of 2018 to 590 in Q1 2019 and 640 last quarter.

At the start of this year, the Intermediary Mortgage Lenders Association warned there could be a “watershed” moment during 2019 as landlords begin to feel the effects of the tax shake up.

The changes to mortgage interest relief have been phased into the system since April 2017.

Before 2017, landlords could deduct all mortgage interest payments from their tax bills. This meant they were taxed on their profits, not their turnover, so reduced the overall bill.

But the rule changes meant tax relief on mortgage interest was phased out and instead landlords receive a tax-credit based on 20 per cent of the interest payments.

Based on a property yielding £950 in rent and a £600 mortgage per month, the landlord's income could drop by about 57 per cent after the rule changes, as the shown in the table:

| Tax year | Proportion of mortgage interest landlords can deduct from their tax bills | Tax bill | Post-tax and mortgage rental income |

| Prior to April 2017 | 100% | £1,680 | £2,520 |

| 2017-18 | 75% | £2,040 | £2,160 |

| 2018-19 | 50% | £2,400 | £1,800 |

| 2019-20 | 25% | £2,760 | £1,440 |

| From April 2020 | 0% | £3,120 | £1,080 |

Source: Which

David Smith, policy director for the Residential Landlords Association, said: “We said at the time people would be blindsided [by the tax changes].

“Some landlords would have been unaware of the tax changes until they felt them and by that point, they were halfway through an even more challenging tax year.”

Mr Smith thought the government had failed at speaking directly to landlords about the changes, adding he was “massively concerned” about the future of the buy-to-let market.

Dan White, director at Champion Hall and White, agreed. He said: “This may well be the effects of lack of preparation, knowledge and understanding of the tax changes which could well be a result of higher tax bills which were not budgeted by landlords.”

Mr White also said landlords looking to exit the market could be struggling the sell in a stifled property space, resulting in unoccupied properties, arrears and more repossessions.

L&C Mortgages’ director of communications David Hollingworth said it was crucial landlords took advantage of the competitive mortgage rates on offer to manage their costs as well as possible as the changes to tax relief were “feeding through”, while Nick Morrey, product technical manager at John Charcol, said some landlords had probably “thrown in the towel” over the tax changes.

Alan Lakey, director at Highclere Financial, said the market had experienced a “vile mix” of changes which were a “recipe for repossessions”.

Other changes to the buy-to-let space included a 3 per cent stamp duty surcharge for second homes and more stringent affordability testing from the Bank of England.

Martin Stewart, director of the Money Group, said: “I would suggest this a very worrying trend, not only for buy-to-let but for the wider lending environment.