The Lindsell Train Global Equity Fund has taken a 3 per cent stake in a US-based analytics company that one of the fund’s managers said was so apt a Lindsell Train holding, it is a surprise the fund has not held it before.

Fair Isaac Corporation (FICO) provides consumer credit ratings to credit investors and consumers in the US.

Fund manager of the Lindsell Train Global Equity Fund James Bullock said in a monthly update for the fund on Thursday (May 5) that he hopes the new position will ‘excite few eyebrows’.

Bullock said since before the pandemic, the fund’s managers have been looking for ways to participate in the ‘extraordinary wealth creation synchronous with the reshaping of world markets around capital-light digital leaders’.

The challenge, he said, was to find companies that are both successful now, while also showing signs of being able to continue that performance far into the future.

“This challenge is accentuated by a key strength – and sometimes weakness - of our approach: our insistence on heritage,” he said.

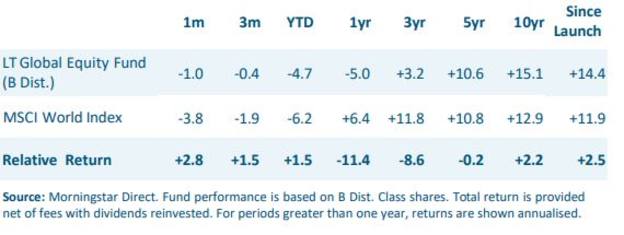

Lindsell Train Global Equity Fund returns to April 30 2022

Bullock outlined how the core of FICO is its credit ratings scores, which the company sells more of per day ‘than McDonalds hamburgers or Starbucks coffees’.

He said the company has almost no direct competition, with 98 per cent of US securitisations citing FICO as their sole risk measure.

The fund’s investment in FICO has been prompted by a recent softening of the company’s share price, Bullock said, though it is still trading at earnings multiples of between 25 and 30 times.

“Why might this [purchase] be justified and where do we go from here?” he said.

“Supported by the long-term fall in interest rates, volumes across FICO’s end markets (mortgages, auto loans, credit card issuance, etc,) have grown at a steady if gentle pace, dented only by the financial crisis,”

“All told, FICO has grown company-wide earnings at 11 per cent for the past two decades, in what appears to be a stable, even accelerating trend.”

Half of the firm’s revenue comes from a suite of analytical and decisioning tools, Bullock said, which at worst provides divestment optionality, and at best hints to ‘significant earnings upside’.

The fund outperformed its benchmark in March, returning -1 per cent compared with the MSCI World Index which returned -3.8 per cent.

sally.hickey@ft.com