There are four main reasons why bond fund trackers have been significantly underperforming the index they are designed to track, a credit specialist has claimed.

Stephen Baines, fund manager for Artemis Investment Management, said: "Exchange-traded funds have delivered disappointing returns in the credit space, underperforming the markets they are meant to track."

This has been despite significant inflows of money in recent years into passive funds such as ETFs that track bond indices, as investors have sought ways to get exposure to credit without paying active fees or as a way to play the market through higher-frequency trading.

But according to Baines, these strategies can work against the investor, causing them to end up with a fund that has a high concentration of risk, not to mention trading costs, and a significant deviation from the performance of the underlying bond index.

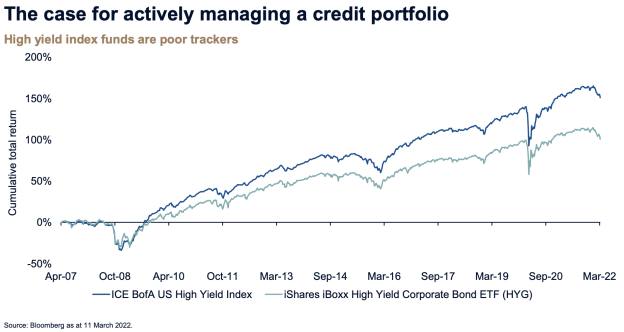

In a recent presentation, the manager highlighted the relative performances of the ICE BofA US High Yield Index against a typical ETF, in this case, the iShares iBoxx High Yield Corporate Bond ETF.

As the image below shows, the performance of the index has been much better than the fund designed to track it.

Baines said there were four main reasons for this underperformance: fees, sampling error, trading costs and liquidity preference.

1) Fees

Baines said: "The index doesn’t include fees, so these become an immediate headwind. "Equity ETFs are very cheap. For example, the SPDR S&P 500 ETF Trust is just 9.5bps, but credit ETFs are not."

Using the iShares iBoxx High Yield Corporate Bond ETF as an example again, this is 48bps.

When you consider that some actively managed bond funds can be around the 50bps mark, there appears to be little difference in price between paying for active or passive.

2) Sampling error

When it comes to sampling error, Baines explained that investors in bond fund indices can end up on the wrong side of credit risk.

Basic equity index construction works on market capitalisation. With a bond index, the index is constructed based on how much credit a company has issued.

But even when an ETF 'tracks' the index, it will not hold all the companies that are in that bond index. This automatically skews the ETF towards the most indebted issuers, which could pose enormous risks.

Baines explained: "There are more than 2,000 bonds in the US high yield bond market, but the leading ETF holds 1,321.

"While this is still a lot, many of the excluded bonds are smaller (less indebted) issuers and so the fund is concentrated in larger (more indebted) issuers."

3) Trading costs

Another key point is that the index return excludes trading costs. Baines said: "Unlike in equities, where index turnover is slow and small, it is impossible to run a buy-and-hold strategy in credit.

"Investors are forced to trade to reinvest proceeds from redemptions, to buy or sell issues that enter or leave the index through rating changes, and the ETF is a forced buyer of new issues after they have occurred."