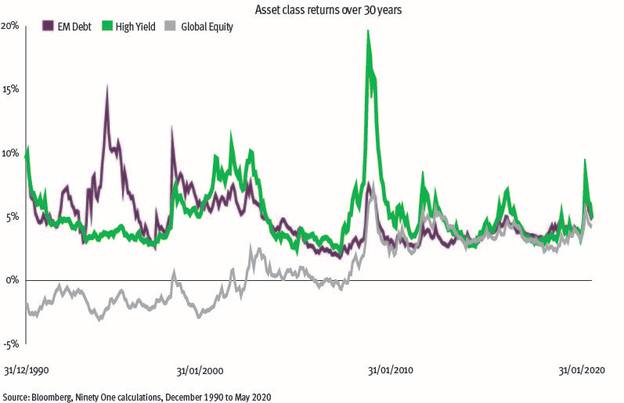

Income drives the majority of long-term returns for most asset classes.

This is the case for equities where reinvested dividends are typically responsible for more than half of cumulative returns, but also for high-yield corporate bonds where the income received can even exceed the total return due to a portion of capital being lost to defaults.

Since the global financial crisis, however, yields have fallen dramatically, and Covid-19 has exacerbated the issue, with central banks doubling down on ever-looser monetary policy to try to stimulate economic activity.

Key Points

- Income drives returns for a lot of asset classes

- It is possible to earn attractive yields in government bond markets

- The higher-yielding equity sector has less resilience

As a result, government yields have been pushed close to or even below zero.

Policymakers are clinging to the belief that endlessly looser policy will eventually generate higher growth and inflation. For this to work, low interest rates and quantitative easing will probably be needed for the foreseeable future.

The US Federal Open Market Committee, for example, is not expecting to increase interest rates at all over its entire three-year forecast horizon.

The good news, however, is that there are still attractive yield premia to be earned across a range of assets and securities.

The yield advantage over government bonds offered by corporate bonds and emerging market debt is above the 20-year median, while the earnings income premium offered by global equities is also above the average seen since the global financial crisis, and well above the levels that prevailed for the two decades prior to that.

Even in government bond markets, there are opportunities to earn relatively attractive yields in state and provincial bonds, and in selected longer-dated maturities.

These yield premia exist for a reason, however, with plenty of businesses and borrowers in financial distress. We have already seen a slew of dividend cuts, especially in sectors that were already under pressure, and we are now beginning to see a wave of pandemic-driven company failures and defaults.

In this environment, investors need to be selective in what they own and know what to avoid.

History shows that the highest-yielding assets are often compromised and can deliver disappointing returns along with significant risks.

The yields they offer are essentially illusory, because their underlying assets struggle to generate sufficient cash to cover their income payments.

Better returns for less risk can generally be found in moderately high-yielding securities where the yields are properly underpinned by resilient excess cash flows. In essence, investors need to distinguish between investment oases and investment mirages.

Equity markets

In the equity markets, oases are more likely to be found in companies with a mix of above-average dividends, supported by excess cash flows, but with lower leverage and higher profitability than their peers, and priced at valuations that suggest there is potential for capital upside or at least stability.

In the healthcare and staples sectors, for example, there are currently a number of stocks offering above-average yields, but with organic and relatively stable earnings growth. This provides a backstop to their dividends, with valuations that have decreased significantly of late.