Liontrust is to merge two underperforming funds it assumed control of following its acquisition of rival Neptune.

In a statement today (August 19) Liontrust confirmed the £88m UK Mid Cap and £10m UK Opportunities funds would be merged into its £480m UK Growth fund, subject to investor and regulatory approval.

It comes as fund manager Mark Martin, who oversaw the two funds, has been put on gardening leave with immediate effect before leaving the FTSE-250 fund house "in due course".

Liontrust said the merger was "in the best interests" of investors. The funds will now be managed by Anthony Cross and Julian Fosh with immediate effect.

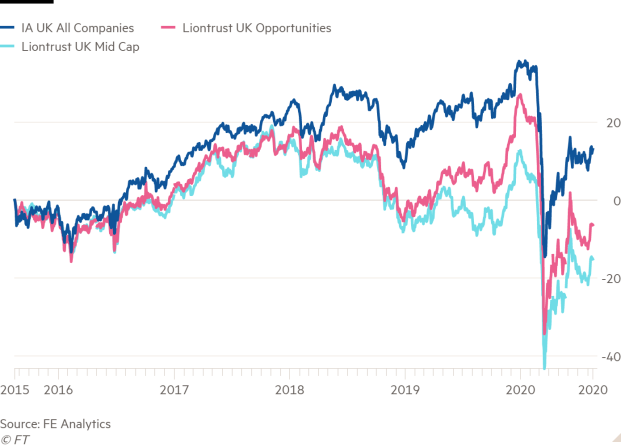

The £10m UK Opportunities fund is among the worst performers in the IA UK All Companies sector over a six-month, one-year, three-year and five-year period.

Over five years, it has lost 6 per cent compared to the sector's positive 13 per cent return.

The UK Mid Cap fund has fared little better. Over the past three years it has lost 25 per cent, compared with the sector's loss of 4 per cent, while over five years it has lost 15 per cent.

Other funds have thrived since Liontrust's takeover of Neptune. Storm Uru's Global Dividend fund has grown from £13m to £42m since September 2019 and is among the top performers in its sector.

In October last year Liontrust acquired Hammersmith-based fund house Neptune and rebranded the firm alongside all of its funds.

The deal saw Liontrust inherit a total of 19 funds — ranging from global and income to regional and emerging market.

rachel.mortimer@ft.com and imogen.tew@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.