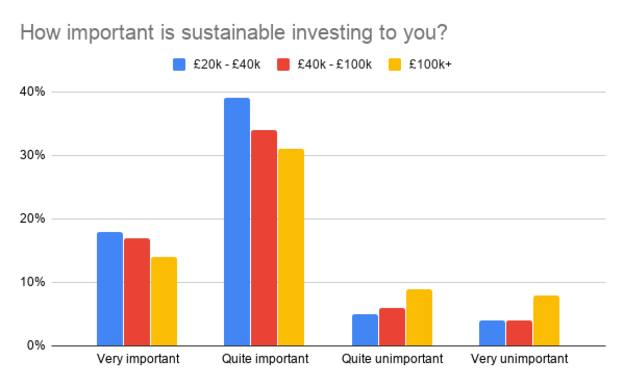

Wealthier investors are less susceptible to sustainable investing than their less wealthy counterparts, data has shown.

Figures from Investec, seen by FTAdviser, showed 14 per cent of consumers with investable assets of more than £100,000 thought it was ‘very important’ the companies they invested in had a positive impact on society and the environment.

This compared with nearly a fifth (18 per cent) of those with investable assets between £20,000 and £40,000 and 17 per cent of respondents with £40,000 - £100,000.

The findings showed typically, the wealthier the investor the less likely they were to be concerned about sustainable investing.

Indeed, of the 1,150 people Investec polled in April this year 17 per cent of those with assets over £100,000 marked sustainable investing as ‘unimportant’, while only 10 per cent of those with assets less than £100,000 thought the same.

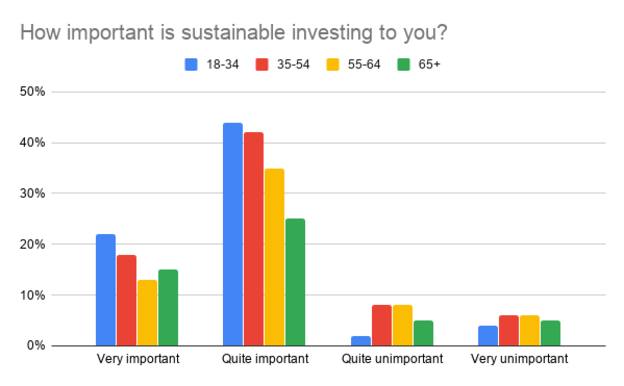

There was a similar pattern for different age brackets — in general, the older the investor was, the less likely they were to think of sustainable investing as ‘important’ to their investment plan.

While 32 per cent of respondents between the ages of 18 and 54 said sustainable investing was either very or quite important to them, just 22 per cent of those aged 55 or above agreed.

There was a less clear divide between male and female investors. A similar proportion of male and female investors (16 and 17 per cent respectively) marked sustainable investing as very important while 6 per cent of men and 6 per cent of women overall said it as very unimportant.

The gender divide was more severe in the nuanced responses however, as 40 per cent of women investors polled said sustainable investing was quite important — 10 per cent more than their male counterparts.

| How important is sustainable investing to you? | Male | Female |

| Very important | 16% | 17% |

| Quite important | 30% | 40% |

| Neither | 37% | 29% |

| Quite unimportant | 7% | 6% |

| Very unimportant | 6% | 5% |

| I don't know what it is | 4% | 4% |

Alan Chan, director at IFS Wealth & Pensions, said the results were in line with his own experiences.

He added: “It’s widely reported that there’s going to be a huge amount of wealth transferred to younger clients in the next ten years and it’s important to be able to cater for their needs in order to attract new clients but also to retain clients too.”

Felix Milton, chartered financial planner and Philip J Milton & Company, agreed, adding that ESG investing was “becoming the norm” and there would be “natural shifts to accommodate these preferences”.

Investec’s research comes as the asset manager launches the UK’s first retail ESG-linked deposit plan.

The FTSE4Good six-year deposit plan is a six-year fixed term plan tied to the FTSE4Good UK 50 — an index made up of the largest 50 companies in the FTSE which meet the ESG criteria.

It returns 18 per cent, the equivalent to 3 per cent a year, if the index is higher at maturity than its starting level. If it is lower, the investor gets back the initial deposit.

Michael Last, head of product design and plan management at Investec Structured Products, said: “This research suggests that ESG investing isn’t a niche: it speaks to values and concerns held across all age groups and wealth brackets.