The £173m UK Mortgages investment trust has successfully thwarted a prolonged takeover attempt from M&G Investment Management.

On behalf of its Specialty Finance fund, M&G has made several approaches in the past month to the board of UK Mortgages, a debt-focused investment trust, with a view to take over the company.

Stock exchange filings, published last week (August 14), showed M&G made an increased and final offer of £191m for the trust — up from £183m — claiming this represented a 42 per cent premium on the trust’s average three-month share price.

But the board of UK Mortgages immediately rejected the offer and M&G confirmed it did not intend to make another bid for the company.

In a statement published yesterday (August 17), the chairman of UK Mortgages, Chris Waldon, said: “While the offer period has now ended the board is very aware of the feedback from shareholders received through the period.

“The board is committed to ensuring that the review of future strategy provides shareholders with a strategy that delivers a clear pathway to enhanced liquidity as well as a narrowing and removal of the discount at which the shares trade.”

M&G said it was “disappointed” with the rejection of its increased offer, saying UK Mortgages had not allowed all shareholders sufficient time to evaluate the offer and provide feedback to the board.

It maintained that its offer represented the best opportunity for shareholders to exit the trust at an attractive price without delay.

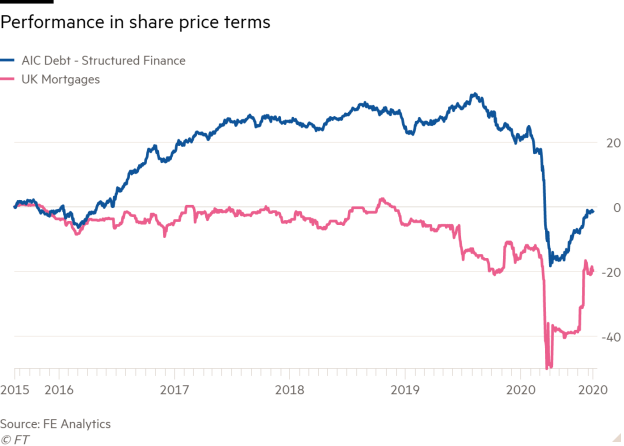

Alan Brierley, analyst at Investec, said it would "interesting" to see the results of the UK Mortgages's strategic review as the board could be left with "egg on its face" for turning down the offer if the trust's performance did not improve.

He said: "This has been another investment trust in the specialist debt space that has promised the earth and under-delivered. UK Mortgages has been a disappointing experience for investors."

Investment giant M&G had already doubled down on its takeover attempts, releasing a stock exchange announcement at the end of July urging the company’s shareholders to initiate discussions with its board.

It had branded UK Mortgages’s dividend policy as “unsustainable” and claimed the trust’s net asset value was not an accurate representation of its current true worth.

In an attempt to bat away the takeover attempt, UK Mortgages had published a strategic update saying it intended to restore the company’s dividend to its annual target level of 4.5p per share, which represented a yield of 7 per cent.

It also said the offer made by M&G was “unsolicited” and explained that together with its financial adviser, Numis, the board had “unanimously rejected” the offer.

UK Mortgages said it had concluded the terms offered “materially undervalued” the company and its prospects.

Run by Twentyfour Asset Management, the UK Mortgages trust had been trading at a premium until the beginning of last year, when it slipped to a 15 per cent discount throughout 2019.