Think it’s only millennials who care about responsible investment? Think again. Ryan Medlock, Royal London’s Senior investment development and technical manager, looks at what the wider demand for environmental, social and governance (ESG) factors is really like.

Once upon a time, we were told that it’s just the millennials who were interested in responsible investment. Tech-savvy folk who enjoy avocado on toast washed down with a fine flat white.

Well, take it from me as someone who just makes it into the age bracket of a millennial, that’s true - to an extent. This is very much a demographic for which responsible investment is a natural fit. That’s important from an inter-generational wealth transfer aspect; as a growing portion of the population are interested in this, by offering a service and a proposition that includes responsible investment, you’re effectively future-proofing your business.

But what if I told you that this demand pool story goes much deeper than just millennials?

Results of our customer research

We recently captured the views of over 5,500 existing Royal London customers to gauge their views on responsible investment*.

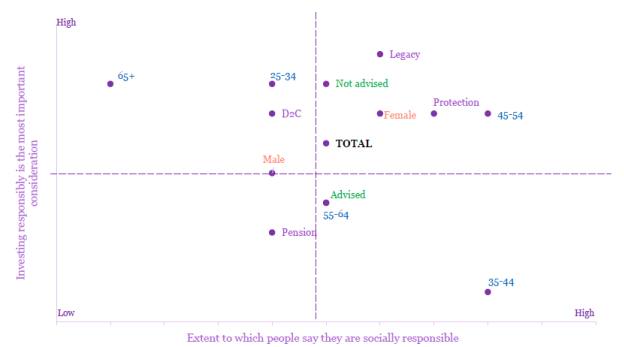

As part of the research, we asked a variety of questions on different responsible investment themes. One particular area of focus was to establish the importance of responsible behaviour versus responsible investing, and the results were quite compelling as shown in the chart below.

The ‘X’ axis shows the extent to which those customers surveyed say they are socially responsible. I think it’s quite clear from these results that responsibility and sustainability is an increasingly important aspect of day-to-day life and decision making – that’s represented by this large pool of groups situated on the right hand side of the chart.

The ‘Y’ axis shows the extent to which those customers stated that investing responsibly is the most important consideration. I think it’s quite clear that by looking at those results in isolation, making responsible and sustainable investment decisions remains less important than other aspects such as the perceived investment return and risk for certain groups of individuals.

The rise of the new demand pool

The story, however, takes a twist when we focus on the top right quadrant. If we take a closer look- we can see a new demand pool emerging.

These are people who place importance on behaving responsibly on a day-to-day basis and believe that investing responsibly is an important consideration.

When you look at the detail in the plot, it’s pretty clear that this isn’t just about the younger generations. It’s also about females as a demographic, and interestingly, those individuals who have yet to engage with and enter the advised market.

How we go about engaging this demand pool and ensuring that the individuals within it ultimately enter the advised market at some point in the future could be a defining moment for many of us.

Future-proofing your business

Embedding responsible investment is not just about finding new customers or appealing to a wider portion of the population - it’s also about continuing to understand the evolving needs of your existing customers.