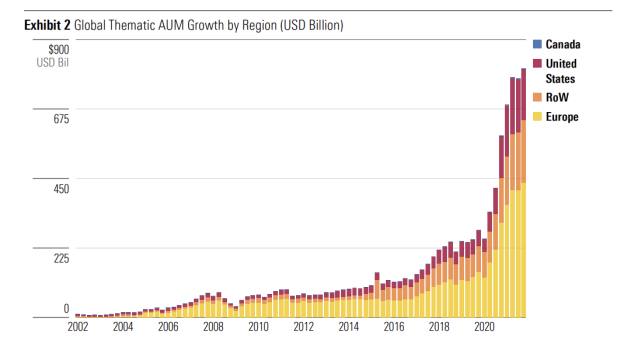

Thematic assets have tripled since 2018 and now represent 3 per cent of all assets in equity funds globally, but their often higher fees have scuppered long-term performance.

A report from Morningstar stated assets in thematic funds reached $806bn (£614bn) worldwide in 2021, across 1,952 funds defined as 'thematic' by the research firm.

As at the end of 2021, global thematic fund assets represented 2.7 per cent of all assets invested in equity funds globally, up from 0.8 per cent 10 years ago.

A record 589 funds debuted globally last year and all regions experienced net inflows. But growth has been uneven across the regions, with Europe being the largest market for thematic funds, accounting for 55 per cent of global assets.

Growth uneven among geographies

Morningstar defines thematic funds as those that select holdings based on their exposure to one or more investment themes, pertaining to macroeconomic or structural trends above the traditional business cycle.

The Morningstar Global Thematic Funds Landscape 2022 report included active and passive equity funds, mutual funds, and ETFs in its taxonomy. But it excluded other asset classes, such as fixed-income, saying their investment profile was "less suited to capturing the growth potential of emerging themes, and consequently the market for these funds is largely nonexistent."

Sustainable funds were also included, provided they sought to capture a specific theme.

According to Morningstar, the growth of thematic funds has been uneven across geographies, with Europe-domiciled funds growing their share of the global pie to 55 per cent, from a mere 15 per cent in 2002.

But in the US, which saw the launch of the first thematic fund in 1948 in the form of Television Shares Management Corp.'s The Television Fund, market share of the assets shrank to 21 per cent in 2021, from 51 per cent 20 years ago.

While all regions have experienced net inflows in the three years to the end of 2021, Europe and the US benefitted the most, netting $200bn (£152bn) and $97bn (£74bn) in new flows respectively.

Net inflows in 2021 were particularly noteworthy, Morningstar said. In 2021, global net inflows reached $188bn (£143bn), up from $139bn (£106bn) a year earlier.

Though a separate report from Morningstar showed flows into European thematic ETFs slowed in the first quarter of 2022 to €0.6bn (£0.5bn), marking the first quarter of flows under €1bn (£0.8bn) since 2019.

Active and growth dominate

Morningstar looked at both active and passive equity funds and found almost three-fourths of assets invested in thematic funds were actively managed, including 90 per cent of Aum in Europe.

Bucking the trend was the US, where 71 per cent of thematic fund assets were passively managed, reflecting the success of thematic ETFs in the region.

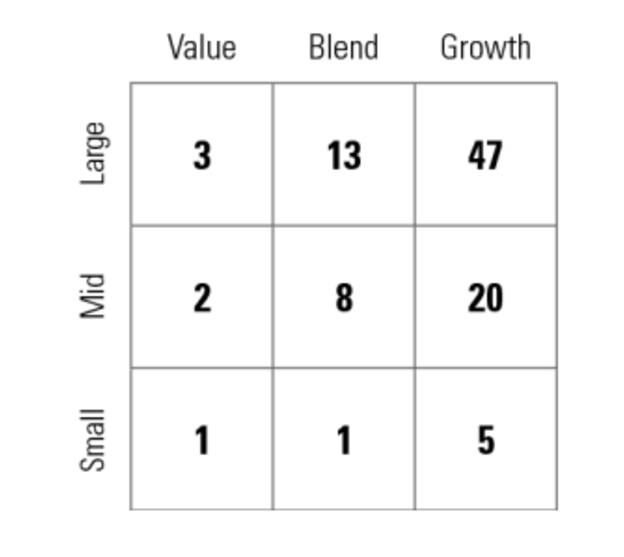

Morningstar said thematic funds tended to come out of growth narratives, which were dominant in the years leading up to 2021 when interest rates were low. In total, 72 per cent of the thematic funds the report looked at had a growth bias, while 6 per cent had a value tilt.

Morningstar stated: "This shouldn't be a surprise, as most thematic funds are seeking to tap emerging themes with large growth potential, such as technology."