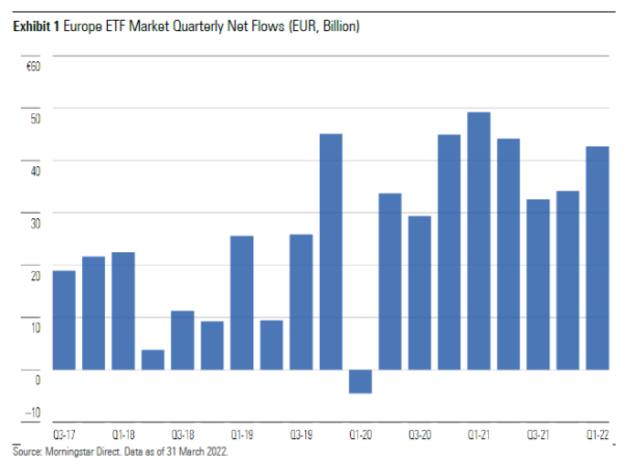

Fund flows into European ETFs have risen 25 per cent in the first quarter of the year but assets under management stalled amid a dip in stock and bond market valuations triggered by the war in Ukraine and rising inflation.

The European ETF market gathered €42.7bn (£36bn) of new funds in Q1 2022, according to Morningstar’s latest European ETF Asset Flows update published this month. But total assets remained unchanged at €1.4tn (£1.2tn).

Most of the £25bn put into equity ETFs went into US large-cap blend equity and global large-cap blend equity ETFs, while several S&P 500 and MSCI World ETFs were among the top 10 money-gathering funds in the quarter.

However, the increase in flows was more than offset by the losses experienced by equity markets during the first months of the year, with the MSCI World Index falling by 5.15 per cent, while the S&P 500 saw a dip of 4.6 per cent, the MSCI EMU Index dropped by 9.1 per cent, and the MSCI Emerging Markets Index fell 7 per cent.

As a result, assets in equity ETFs fell to about £809bn from £820bn at the close of 2021, according to Morningstar, which said Q1 had also seen investors direct money to ETFs offering exposure to value stocks.

It said: "Once again, the ETF market proves a good gauge of investor behaviour. In this case, the sizeable drop in equity market valuations during the period was seen as a buying opportunity by some investors hoping to reap the rewards should markets rebound in coming quarters."

Bond ETFs suffer

When it came to bond ETFs flows decreased 40 per cent in the period, from €8.4bn (£7bn) in Q4 2021 to €5.1bn (£4.3bn) in Q1.

High inflation had already prompted the US's and UK's central banks to raise rates while the European Central Bank confirmed it would end its bond-buying programme. But further intervention could be needed, prompting bond indices to fall.

"The economic situation remains rather uncertain heading into the second quarter, but the consensus view among investors is that more aggressive policy intervention will be needed in coming quarters to fight rising inflation," said Morningstar.

"All this has done little favour to bond market valuations, with both government- and corporate-bond indexes showing sizeable falls.

"As a result, flows into bond ETFs were more than cancelled by capital losses, and assets dipped to €304bn (£256bn) from €310bn."

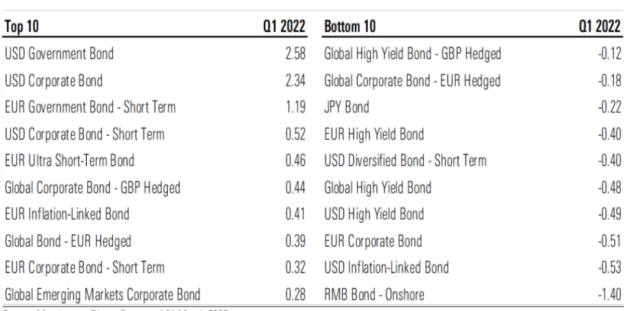

In terms of categories, the bulk of money went into developed-markets bonds such as US government and corporate, which "simply confirms that in times of market stress, US assets will always prove to be the ultimate safe haven for investors," the report said.

Top and bottom categories for fixed income ETF net flows in Q1:

When it came to ESG aligned products, flows amounted to €13bn (£11bn) in the first quarter, less than half the €27bn seen in the fourth quarter.

The flows accounted for 30.4 per cent of total flows into ETFs but this was down from the record high of 79 per cent seen in the previous quarter.